According to a 2025 report by Nielsen, titled “Undervalued to Unstoppable”, women’s football will reach 800 million fans worldwide by 2030. This marks a 38% increase from current levels, and it changes the way we think about growth in women’s football. The question should no longer be: Will the fanbase of women’s football grow? Rather, we should ask ourselves: Where will this growth take place?

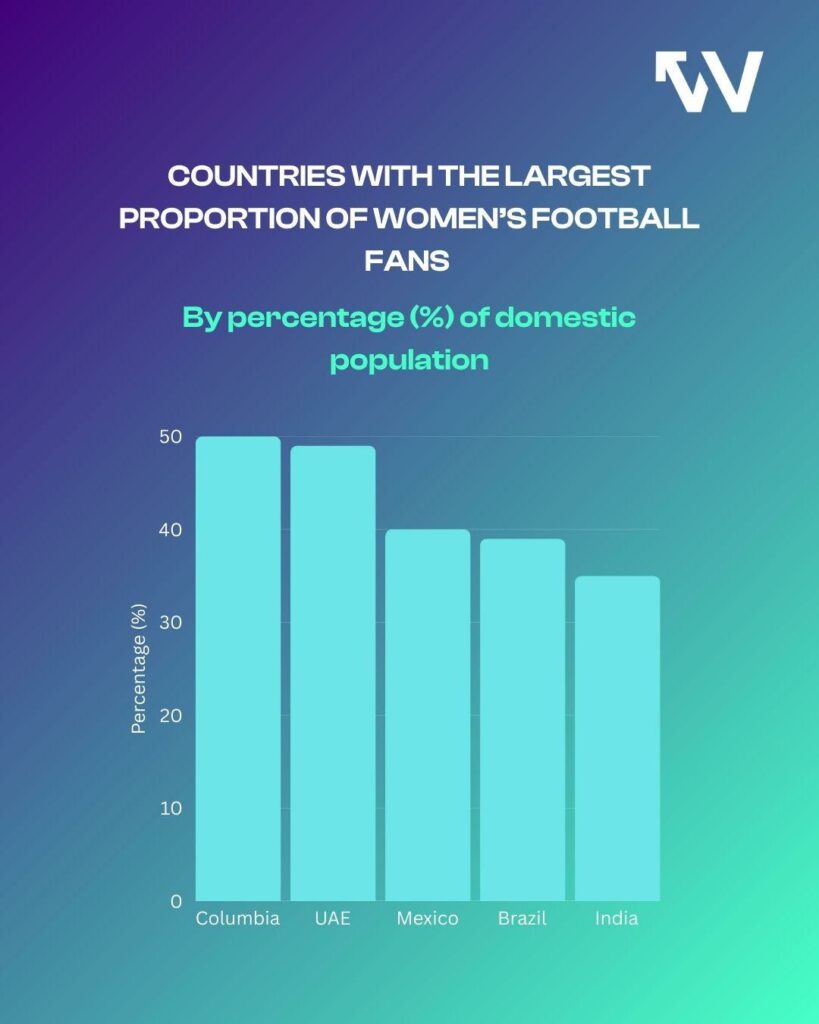

Much of the current attention around women’s football is focused on the USA, the UK and other European countries. While their growth has been remarkable, one can tend to forget the incredible fan potential that lies in countries outside of the traditional women’s football powerhouses. The Nielsen report identifies the countries with the largest proportion of women’s football fans by percentage of domestic population – and the findings may be surprising for many.

Europe and North America are nowhere to be seen. Instead, Latin America emerges as a crucial market for women’s football. Participation figures tell a similar story. Between 2019 and 2025, the number of registered players increased by 300% in China and 42% in Vietnam. In Mexico, China, Saudi Arabia and India, more than 6% of the population plays women’s football – a level that most European markets, including France, the Netherlands and the UK, do not reach. Participation matters commercially: Nielsen’s research indicates that those who play football are 26% more likely to become dedicated fans. As grassroots numbers climb, so does the likelihood of long-term engagement with leagues, clubs and sponsors.

Before taking a closer look at three key global markets for women’s football, it’s important to understand the demographic of those fans.

The fanbase of women’s football: international and well-off

Even before Nielsen’s 800 million projection, growth had been strong. Over the past five years alone, the fanbase expanded by 60%. By the end of the decade, women’s football is expected to rank among the five most popular sports globally.

The composition of that audience is just as important as its size. Nielsen estimates that 60% of fans will be women. Nearly half (47%) are among the top income earners globally, compared with 37% of the general population. For brands, this is a commercially attractive demographic.

New research published in January 2026 by WSL Football and YouGov reinforces the point. Across the Women’s Super League and Women’s Super League 2, WSL Football counts 103 million global followers, of whom 28.5 million are considered active fans. International markets already play a central role. The United States is the largest overseas audience, but Japan ranks third and generates the highest YouTube views among non-UK markets.

In other words, women’s football is building a global audience that is young, digitally fluent and commercially valuable. Three markets in particular deserve more attention when it comes to the growth of the global women’s football fanbase: Brazil, Mexico and Japan.

Brazil: The 2027 World Cup as a unique opportunity

According to Nielsen, women’s football is currently the tenth most popular sport globally. Brazil is a step ahead, though: Research from Grupo Globo shows that women’s football is already the second most popular sport in the country. Around 31% of Brazilians identify as fans, 63% express interest, and among 16- to 24-year-olds interest rises to 76%. For a country of more than 200 million people, those percentages translate into significant numbers.

That momentum can already be witnessed. Corinthians have built one of the largest digital followings in the women’s game, with close to two million social media followers and consistently high engagement rates. Their narrow extra-time defeat to Arsenal in the inaugural Women’s Champions Cup demonstrated that Brazilian teams can compete with Europe’s elite. Even though the game was being played in England, the Brazilian fans made themselves heard, showing that they can compete off the pitch as well as on it.

At the national level, the transition from one generation to the next is underway. Marta, the defining figure of Brazilian women’s football for two decades, is gradually stepping aside for younger players. With Brazil set to host the 2027 Women’s World Cup, the tournament is widely seen as a catalyst that could convert casual observers into committed supporters. By winning Olympic silver in 2024, the national team already showed that they can cause enthusiasm in the country that lives and breathes football.

There have also been institutional shifts. The federal government introduced a National Strategy for Women’s Football, and Decree No. 11,458, signed by president Lula da Silva, outlines measures such as dedicated training centers and tailored development methodologies for girls and women.

The broader Latin American landscape remains uneven. Colombia’s passionate fans were a highlight of the World Cup in 2023. At the same time, structural challenges persist in parts of the region, including underfunded leagues and disputes over working conditions, as seen in Argentina in recent years. For international leagues and brands, this can also be an opportunity: they witness strong audience interest paired with gaps in domestic commercialization. Those gaps may allow foreign clubs to build direct relationships with fans across the region.

Mexico: Grassroots growth and new faces

Mexico deserves its place on the list of the most important places for women’s football. In 1971, the country hosted an unofficial Women’s World Cup final attended by roughly 110,000 spectators. This is still the largest crowds ever recorded for a women’s sporting event, and the recent film Copa 71 tells the story of the tournament.

The modern professional era has added structure to that interest. Liga MX Femenil has attracted established international players such as Geyse, Eugénie Le Sommer and Ève Périsset, raising the league’s profile. In 2024, more than 50,000 fans attended the final between Monterrey and Tigres.

A FIFA benchmarking report ranked Liga MX Femenil second globally for average attendance in the 2021–22 season, behind the NWSL. Although attendances have fluctuated since and salary levels remain modest for many players, the underlying interest appears strong. The Mexican Football Federation estimates that 26 million of the country’s 34 million football fans are interested in the women’s league.

Grassroots growth is particularly striking. The number of women and girls playing organized football in Mexico is 1.5 million in 2024, according to FIFA. And as the Nielsen report shows, football players are likely to be football fans as well.

Japan: Star players attract attention abroad

For Japan, the situation is a bit different. While domestic growth is sustained but slow, Japanese internationals playing abroad can be a great opportunity for European and North American clubs to enter the market.

After winning the Women’s World Cup in 2011, the national team sparked widespread enthusiasm. While that surge was not fully converted into sustained league growth at the time, recent reforms suggest a more stable foundation. In the WE League, top-tier clubs are now required to have at least 15 players who can earn a living from the sport. Average attendances surpassed 2,000 last season for the first time, with a peak crowd of 26,605.

Most importantly, Japan is a crucial important overseas market for European leagues. It ranks as the third-largest international audience for the WSL and generates the highest YouTube views among overseas markets. Players such as Yui Hasegawa and Aoba Fujino at Manchester City, Momoko Tanikawa at Bayern Munich and Jun Endo at Angel City FC draw strong followings from home.

Clubs have begun to respond more deliberately. For example, Manchester City have been actively nourishing this bond when players met with members of Manchester University’s Japan Society after a match. Clubs should support their international players in the process of building a brand at home, hoping to turn fans of one player into fans of a club.

Conclusion: Women’s football growth is a global phenomenon

Women’s football is entering a new phase. The overall growth figures are impressive, but the geography of that growth may prove even more important for the future of the sport. Brazil, Mexico and Japan are crucial markets that clubs should tab into.

Author: Helene Altgelt