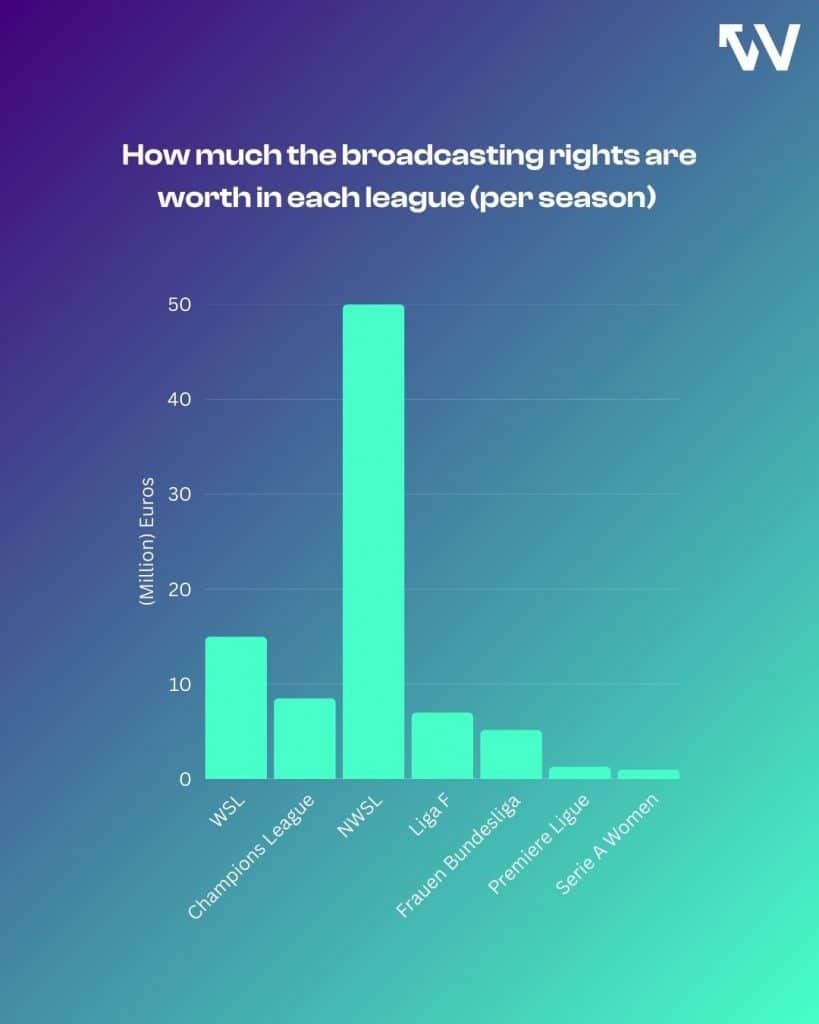

Media rights values vary dramatically across leagues in women’s football, with huge differences even among Europe’s top competitions. The Women’s Super League (WSL) leads the continent, with a deal worth 15 million euros per season, with the deal with Sky and the BBC spanning from 2025/26 to 2029/30.

Internationally, the NWSL set a new standard with its groundbreaking broadcast deal worth 240 million $ over four years. The deal with ESPN, CBS, Amazon Prime Video, and Scripps is worth about 50 million euros per season for the league, running from 2024 and 2027.

This is almost 50 times as much as the current deals in Italy’s and France’s topflight, who lag in terms of broadcasting value with only slightly above one million coming in per year. The German Bundesliga and Spain’s Liga F sit in the middle of the table, with deals worth 5.2 million and 7 million euros, respectively.

Stagnating numbers – in part due to scheduling issues

Recent struggles to even sell rights to the Italian cup illustrate how fragile parts of the European market remain. SportBusiness Media reports that broadcasters and rights-holders increasingly struggle to agree on fair valuations. DAZN’s deal for Liga F, for instance, is now viewed as an overvaluation, having failed to generate the expected subscription uplift. Even in markets with strong rights deals, broadcasters have expressed concerns. In England, some WSL viewing figures have disappointed this season. Arsenal’s 2–1 win over Liverpool, for example, averaged only 59,000 viewers.

This is partly due to scheduling issues, which are one of the most, if not the most important obstacle to increasing the value of media rights in women’s football. Poor scheduling—often causing the women’s and men’s teams of the same club to play concurrently—forces fans to choose. Fans which describe themselves primarily as men’s football fans but also casually interested in women’s football, thus are prevented from growing a stronger attachment to the women’s team.

One solution can lay in finding new kickoff times not yet claimed by the other sports. The German Frauen-Bundesliga has done so by scheduling one game per week on Monday evening, when the men’s leagues don’t play. Yet, this has also drawn criticism as it’s less convenient for fans and players who have a second job next to football. Finding the right balance is crucial here, but leagues should make avoiding schedule clashes a priority.

data analysis: media rights in women’s football remain undervalued

Despite recent struggles, future growth in the value of media deals is on the horizon. This becomes clear when one looks at consumer data. According to survey data from Ampere Analysis, collected in 16 markets, women’s football media rights remain significantly undervalued compared to men’s. “The gap in fandom is far narrower than the gap in media value”, Danni Moore explains, speaking to The Rise of Women’s Football. Her recent report, “European women’s football media rights remain undervalued as fans and viewership grow”, explores this gap.

Moore’s research shows a striking disparity between actual fandom and market valuation. In Italy, France, Germany, the UK and Spain, around 10% of fans compared to fans of the men’s league say they enjoy the top women’s competition. About 4-5%, depending on the league, state that they are willing to pay for watching the top women’s league. The gap between fandom in men’s and women’s football remains considerable, as these figures show. But it’s far less wide than the gap in media rights value. The media rights of the top 5 women’s leagues are only valued at 0.5% of the men’s leagues.

This gap in revenue can, consequently, not just be explained by the lesser number of fans in women’s football, contrary to popular belief. Women’s leagues can use this argument in negotiations, especially since they have a particularly valuable fanbase. A Nielsen Sports report projects that the global women’s football fanbase could reach 800 million by 2030, putting it among the top five sports worldwide. Generation Z and Generation Alpha drive much of this growth—fans who may not yet spend heavily but represent the sport’s long-term commercial backbone.

Free-to-air or pay tv? balancing both is key

Another crucial ambition for women’s leagues must be to turn fans into customers: Not all those which currently describe themselves as fans would also be willing to spend money to watch the competition. To some degree, this is normal: “Across all sports, willingness to pay is much lower than fandom,” Moore explains. “Even for the men’s Premier League—one of the most popular leagues in the world—74% of fans in the UK say they follow the league, but only 54% say they’re willing to pay to watch it.” Yet, when less than half of the fans are willing to pay, leagues should investigate how they can make their product more interesting. Important points of improvement include better angles for the TV cameras, prominent commentators and interesting pre- and post-match coverage.

One particular challenge is that in women’s football, fans have grown accustomed to free-to-air or easily accessible streaming. The WSL’s hybrid model offers a compromise: Sky Sports provides a paid tier for highly engaged viewers, while the BBC boosts free-to-air reach. “It’s a careful balancing act,” Moore notes. “Monetizing rights when fans are used to free access isn’t easy, so the transition is delicate.”

media rights in the digital age – a threat and an opportunity

In this context, the diversification of broadcasters is both a threat and an opportunity. Many fans engage with their favorite team mainly on social media and may watch only short videoclips instead of the full 90 minutes. Yet, the different ways of consuming football can also lead to innovations in the sports media domain. Highlights packages are gaining traction, and YouTube and influencer-led channels provide new distribution avenues. “Social media is becoming an essential content hub,” Moore says. “Fifty-six per cent of global sports fans watch videos of athletes or influencers discussing sport at least once a week—and that figure rises to around 70% among 18- to 24-year-olds.”

The WSL, again, has shown the way by allowing players to own and share their clips on social media. This boosts the players’ personal brands – another key factor for growth – without diluting the media rights package. New kids on the block, like Amazon or Netflix – having purchased the 2027 and 2031 Women’s World Cup rights in the US – show how football and entertainment are increasingly linked.

Broadcasting deals: An essential element for further growth

While social media and digital distribution are growing rapidly, traditional broadcast revenue remains essential. Deloitte estimates that media rights currently account for 25% of revenue across women’s elite sports—far below the 40% typical in men’s football. Over the last years, the value of broadcast deals has increased steadily, but only proportionally to the overall revenue. For truly sustainable growth going forward, breaking the 30% barrier would be crucial.

For this, international exposure provides another route to take for women’s football leagues. Remarkably, 76% of the WSL’s broadcast audience last season came from outside the UK. In markets without a rights partner, the league streams matches live on YouTube. Like in the domestic market, with the Sky and BBC deal, this hybrid model blends visibility with revenue generation.

To sum it up, addressing scheduling conflicts with men’s competitions, improving international packaging, and embracing flexible distribution models will be critical steps for stronger broadcasting deals in women’s football. Mixing free-to-air broadcasters with pay-TV-partners can be a recipe for success. Consumer data already shows that the fandom gap between men’s and women’s football doesn’t justify the gap in media rights valuations. The next step for women’s leagues is to make this argument count and to turn interested fans into loyal customers.

Text: Helene Altgelt