Over the past few years, the landscape of women’s football has undergone a remarkable transformation. As the game becomes increasingly visible on global stages, it has simultaneously grown in professionalism and commercial value. This evolution has attracted new investors, sponsors, and media attention, creating fertile ground for an expanding transfer market. What once represented a small corner of global football has become a dynamic, competitive environment marked by record-breaking deals and growing financial flows between clubs.

The sport’s growing commercial appeal is now clearly reflected in transfer activity. Each year, new records are set as clubs compete to secure top players, illustrating not only increased ambition but also a redefinition of market expectations. The transfer market has become one of the most tangible indicators of the sport’s growth, offering a clear picture of how investment, competition, and opportunity are reshaping the women’s game.

🔙🔵🔴 Yesterday in 2017, Mapi León made history as the first paid transfer in Spanish women’s football, with a fee of €50,000. pic.twitter.com/WVsIaMMZ1T

— Barça Femení (@BarcaFem) August 25, 2025

Record-Breaking Deals in 2025

The summer of 2025 stands as one of the most significant windows in the history of women’s transfers. Within just a few weeks, two record-breaking transfers highlighted the rapid escalation of transfer fees. Olivia Smith’s move from Liverpool to Arsenal for around 1.4 million dollars (approximately 1.1 million pounds) was quickly overtaken by Mexico forward Lizbeth Ovalle’s transfer from Tigres to Orlando Pride (1.5 million dollars). On Women’s Super League deadline day, the bar was raised yet again. Paris Saint-Germain’s Grace Geyoro joined newly promoted London City Lionesses for a reported record 1.9 million dollars.

These signings not only set new financial milestones but also underline a shift in perception. Women’s football is now viewed as a viable investment market capable of generating significant returns, both on and off the pitch.

Explosive Market Growth from 2021 to 2025

FIFA’s Women’s Mid-Year Transfer Snapshot 2025 shows just how dramatic this transformation has been. In the mid-year transfer window of 2021, global spending on international transfers in women’s football stood at approximately 1.43 million dollars. Four years later, that number had soared to 12.3 million dollars which marks an increase of roughly 754 percent. The 2025 mid-year window alone saw spending rise by more than 80 percent compared with 2024, marking a new all-time high in both spending and activity.

The number of transfers followed a similar trajectory. More than 1,100 international moves were registered in mid-2025, a level that highlights how mobility and professionalism have accelerated across the sport. What was once an occasional phenomenon has now become a constant within the women’s football calendar.

Global comparison

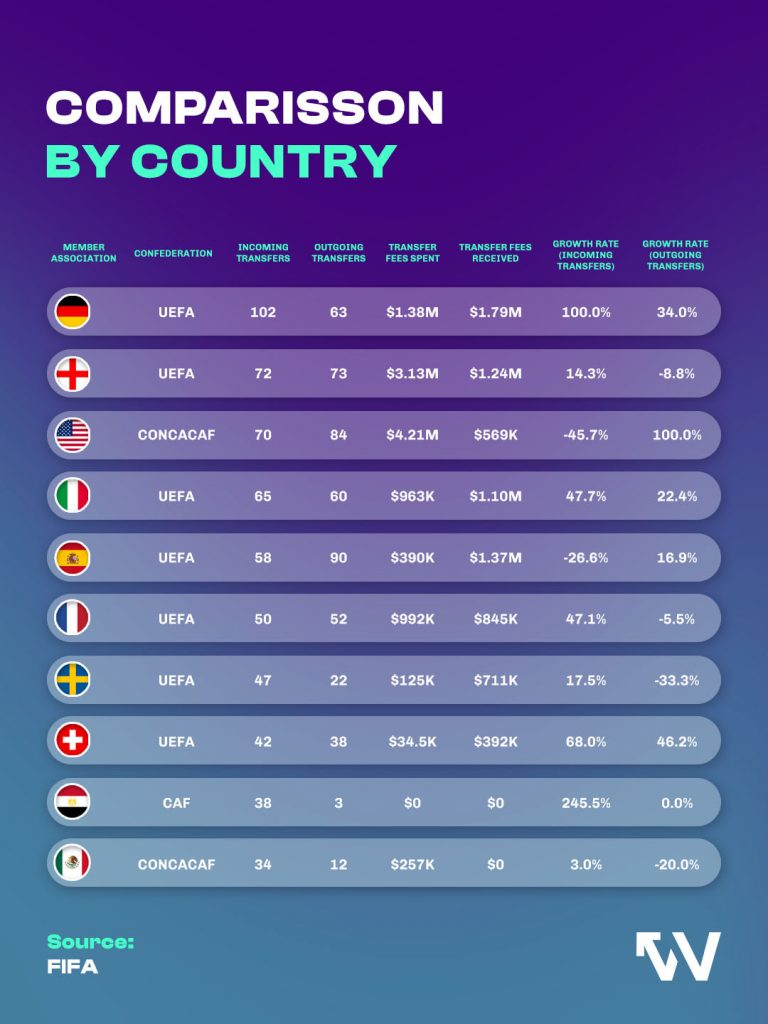

The expansion of the women’s transfer market is not only limited to Europe but is a truly global phenomenon. The United States emerged as the largest spender in 2025, with clubs investing more than 4 million dollars accounting for over one-third of total global transfer spending during that window. This surge underscores the growing financial and competitive strength of the National Women’s Soccer League. For the first time since 2021, it surpassed England’s Women’s Super League in average spending per player.

Regional dynamics reveal an evolving balance of power. While CONCACAF clubs collectively spent more than twice what they received in transfer fees, UEFA’s financial flows remained more balanced. Germany recorded the highest number of incoming international transfers in 2025, with 102 new arrivals. Spain, meanwhile, led in outgoing transfers, with 90 players moving abroad. As a result, Europe remains the central hub of women’s football. Yet, North America, Mexico, and other regions are rapidly gaining influence.

Developments in tranSfer pOlitics

Apart from the financial data, the nature of transfers themselves is evolving. The average age of transferred players has declined slightly each year, from 24.8 years in 2021 to 24.2 in 2025 meaning clubs are increasingly investing in younger players and long-term potential rather than relying solely on experienced professionals. This reflects a more strategic and sustainable approach.

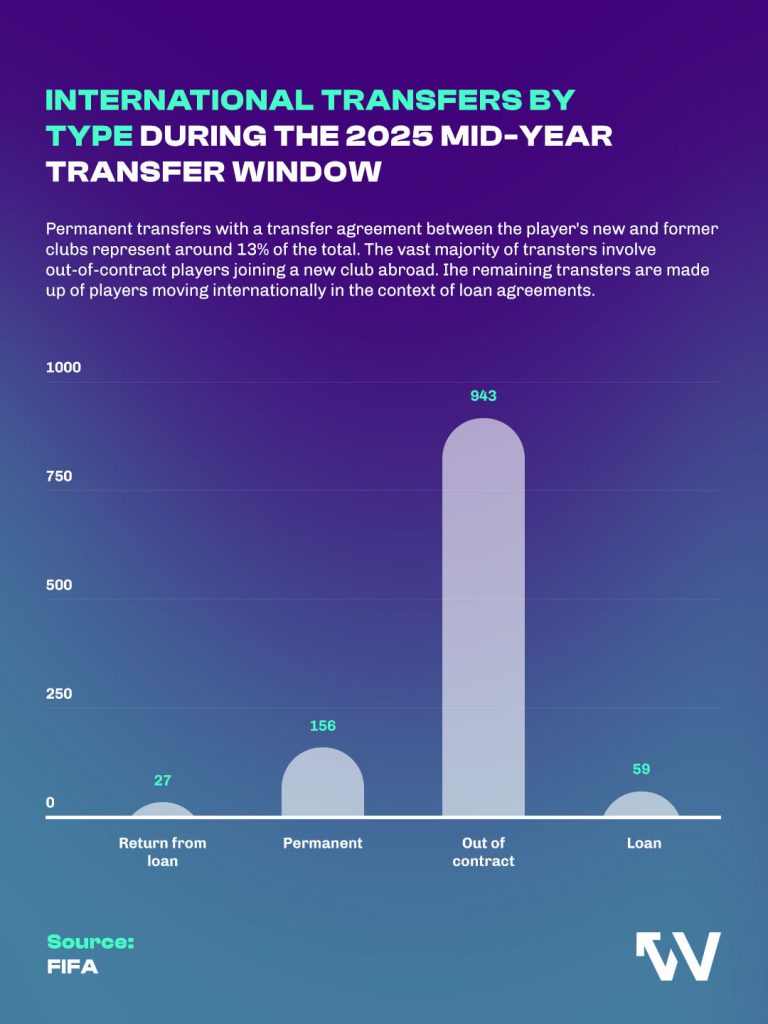

Despite the rise in record fees, the majority of women’s international transfers still occur without any transfer payment. For example, in 2025 943 players moved clubs while out of contract, meaning their previous clubs received no compensation. Only about 13 percent of all international transfers involved an actual fee between clubs, while 59 players were loaned out. While the market is growing rapidly in terms of visibility and value, much of it still operates in a transitional phase balancing between professionalisation and structural limitations.

Average transfer fees offer another indicator of progress. In 2021, the mean value of a paid transfer stood at around 42k dollars. After a slight decline in 2022, the figure has since more than doubled, reaching an average of 80.5k dollars in 2025. This increase reflects not only higher individual valuations but also a greater willingness among clubs to spend.

Differences between leagues are becoming more significant. In the 2025 mid-year window, clubs in the United States paid an average of 263k dollars per player, a record for the NWSL. English clubs followed with 131k, while French clubs also maintained high averages. In contrast, German and Italian clubs spent more modest amounts, averaging just under 50,000 dollars per player. Meanwhile, Mexico’s Liga MX Femenil demonstrated growing financial muscle, with average fees around 64k dollars, surpassing several established European leagues.

The Role of Investment and Ownership

Behind the numbers lies a larger story of institutional change. The women’s game is attracting new ownership models and investor groups who view the sport as a long-term business opportunity. Michele Kang’s Kynisca Sports International, which oversees OL Lyonnes, Washington Spirit, and London City Lionesses, has pioneered a multi-club ownership structure focused exclusively on women’s football. Similarly, the Mercury/13 group, led by Victoire Souki Cogevina and Mario Malavé, has expanded its portfolio with Como Women and Bristol City. In the United States, Angel City FC has redefined the concept of celebrity-backed sports ownership, with investors including Alexis Ohanian, Serena Williams, Jennifer Garner, and Billie Jean King.

These examples show how capital, branding, and visibility are linked to accelerate the sport’s professionalisation. The influx of investment enables clubs to improve infrastructure, attract elite players, and enhance global competitiveness. Yet it also introduces new challenges: the risk of financial disparity between top-spending clubs and smaller ones, and the need to ensure that rapid growth does not come at the expense of long-term sustainability.

Further Growth IN the future?

The years from 2021 to 2025 mark a defining era in the evolution of women’s football. Within just four seasons, the sport has transitioned from a market characterised by modest transactions to one breaking records almost every transfer window. Transfer spending, player mobility, and international reach have all expanded dramatically, creating a more complex and competitive ecosystem.

Transfers now serve as both a mirror and a motor of women’s football’s transformation. They reflect the sport’s growing commercial power and global appeal while driving its next phase of professionalisation. As women’s football continues to grow in visibility and investment, its transfer market has become one of the clearest indicators of its progress and of its potential to shape the future of global sport.

Text: Adriana Wehrens